maine tax rates by town

Detailed Maine state income tax rates and brackets are available on this page. Full Value Tax Rates Represent Tax per 1000 of Value EAGLE LAKE 1445 1575 1679 1650 1564 1618 1565 1458 1455 1466 EASTON 1595.

Maine Sales Tax Small Business Guide Truic

Property tax rates in the county are reasonably close to the state average as the average effective rate here is 145.

. The Town of Yorks 20212022 taxable valuation is 5500701250. Maine is ranked number twenty out of the fifty states in order of the average amount of property taxes collected. The Maine income tax has three tax brackets with a maximum marginal income tax of 715 as of 2022.

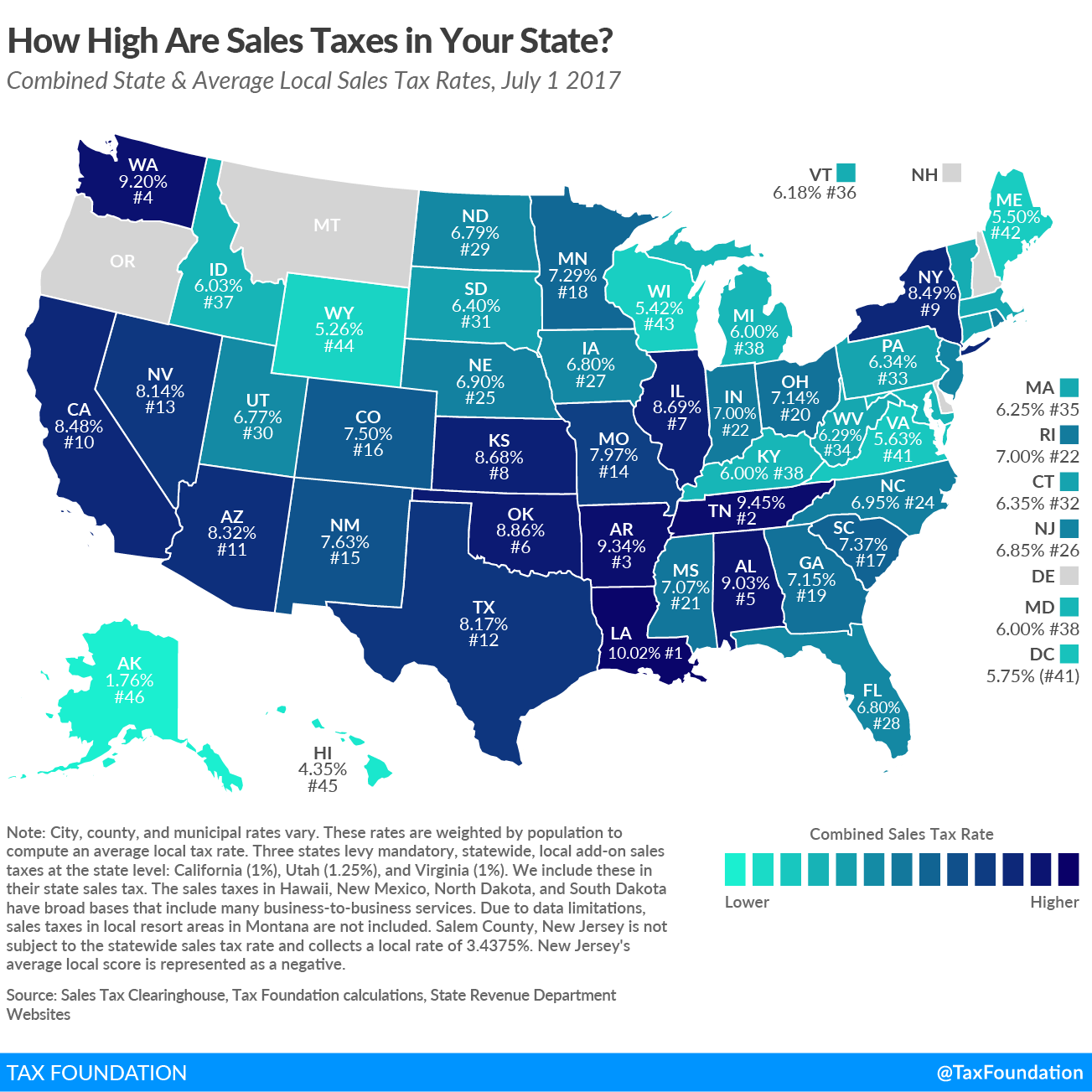

2022 List of Maine Local Sales Tax Rates. Maine has a 550 percent state sales tax rate and does not levy any local sales taxes. To find detailed property tax statistics for any county in Maine click the countys name in the data table above.

Census Bureau The Tax Foundation and various state and local. Local government in Maine is primarily. Combined with the state sales tax the highest sales tax rate in maine is 55 in the cities of portland bangor lewiston south portland and augusta and 104 other cities.

This data is based on a 5-year study of median property tax rates on owner-occupied homes in Maine conducted from 2006 through 2010. Property Tax Resources Statistics. Auburn ME Sales Tax Rate.

Lowest sales tax 55 Highest sales tax 55. Augusta ME Sales Tax. Penobscot County is in central Maine and contains the states third-largest city Bangor.

Full Value Tax Rates. Maine Town. Brunswick me sales tax rate.

The town clerks office performs a wide variety of department functions and services. An important resource for municipal governments in Maine. Local Government in Maine Book.

The Town of Scarboroughs new tax rate is now set at 1502 per 1000 of property value for the 2022 fiscal year which runs from July 1 2021 to June 30 2022. The state valuation is a basis for the allocation of money. Tax amount varies by county.

13 rows The following is a list of individual tax rates applied to property located in the. When the spending plan for the fiscal year that starts July 1 was first proposed it would have added 80 cents to the citys share of the property tax rate bringing it. Municipal Services and the Unorganized Territory.

Androscoggin County has the highest property tax rate in the state of Maine. Box 24 1095 roxbury road tel. The statewide median rate is 1430 for every 1000 of assessed value.

City Total Sales Tax Rate. 27 rows Maine Relocation Services Local Tax Rates. The statewide median rate is 1430 for every 1000 of assessed value.

Our division is responsible for the determination of the annual equalized full value state valuation for the 484 incorporated municipalities as well as for the unorganized territory. Maine has a graduated individual income tax with rates ranging from 580 percent to 715 percent. The median property tax in Maine is 109 of a propertys assesed fair market value as property tax per year.

Maine has a 55 sales tax and Washington County collects an additional NA so the minimum sales tax rate in Washington County is 55 not including any city or special district taxes. Maines tax system ranks 33rd overall on our 2022 State Business Tax Climate Index. Maine also has a corporate income tax that ranges from 350 percent to 893 percent.

The Municipal Services Unit is one of two areas that make up the Property Tax Division. Town Manager Plan. Delinquent Tax Rates - Maximum Allowed.

I created this page after constantly Googling the ratesThe state of Maine publishes this information in a PDF but wanted to be able to sort by mil rate county growth. This unit is responsible for providing technical support to municipal assessors taxpayers legislators and other governmental agencies. At the median rate the tax bill on a property assessed at 100000 would be.

Maines median income is 55130 per year so the median yearly property tax paid by Maine residents amounts to approximately of. Are you looking to move to a town or city in Maine but also want to get a sense of what the property tax or mil rate isYouve come to the right place. The Property Tax Division is divided into two units.

Please contact our office at 207-624-5600 for further information on any of the following. Maine Property Tax Rates by Town The Master List new mainerco. This table shows the total sales tax rates for all cities and towns in Washington County including all local taxes.

Data sourced from the US. 2022 List of Maine Local Sales Tax Rates.

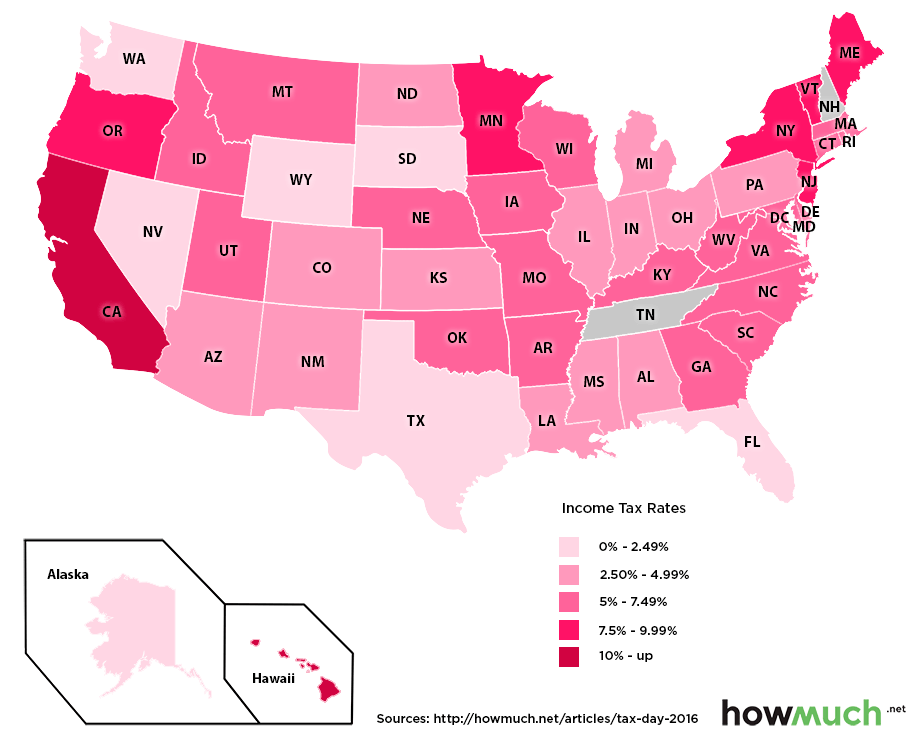

Report States With No Income Tax Get No Economic Boost Income Tax Income Charts And Graphs

Which U S States Have The Lowest Income Taxes

2013 New Hampshire Tax Rates For Lakes Region Town Sorted By Town And By Rate New Hampshire Town Names Winnipesaukee

How High Are Capital Gains Taxes In Your State Tax Foundation

Cigarette Excise Taxes In Select States Per Pack Infographic Http On Wsj Com K81nby Infographic The Selection Tax

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Maine Property Tax Rates By Town The Master List

How Is Tax Liability Calculated Common Tax Questions Answered

Louisiana Sales Tax Rate Remains Highest In The U S Legislature Theadvocate Com

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

How Is Tax Liability Calculated Common Tax Questions Answered

Updated State And Local Option Sales Tax Tax Foundation

States With Highest And Lowest Sales Tax Rates

Maine Property Tax Rates By Town The Master List

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

How Do State And Local Individual Income Taxes Work Tax Policy Center

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com